Whether you’re a long-time business owner or just starting your business , to-do lists pile up fast, and writing a business plan can be a time-consuming task. Using a business plan template like the one below can be an easy way to jumpstart your business planning.

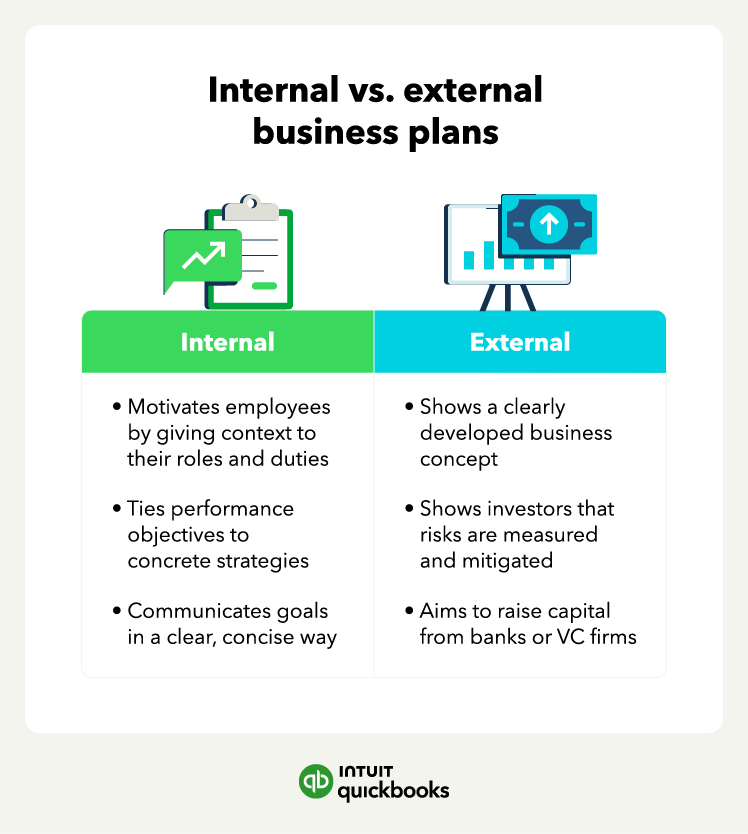

When done right, business plans can help you successfully strategize and create goals. Start with a clear picture of the audience your plan will address. Is it for investors, your bank, your employees, or yourself?

Defining your audience helps you determine the language you’ll use in presenting your ideas. Once you have your audience in mind, you can start creating the 10 key components of your business plan:

There are 10 key parts of a business plan you’ll need to complete:

An executive summary lays out all the vital information about your business within a relatively short space. It’s typically one page or less and acts as a high-level overview that summarizes the other sections of your plan.

Even though it appears first in most business plans, you’ll want to write this section last. It effectively summarizes the ideas from the other nine sections. Your executive summary should focus on the value proposition or unique selling point: an extended motto aimed at stakeholders.

You can follow a straightforward problem/solution format or this fill-in-the-blanks framework:

This framework isn’t meant to be rigid but serves as a jumping-off point.

Your company description should contain three elements, including your mission statement, company history, and objectives. These elements give context to the bigger picture, letting investors know the company’s purpose so your goals also make sense.

Your mission statement is your company’s reason for existing. It’s more than what you do or what you sell. It’s about why exactly you do what you do. Effective mission statements should be inspirational and emotional.

Think about what motivates you, what experiences led you to start the business, the problems you solve, the wider social issues you care about, etc. Don’t worry about making your company history a dense narrative. Instead, write it like you would a profile.

Your business objectives give you clear goals to focus on, so make sure they’re SMART:

Tie these goals to your key results. When you don’t clearly define your objectives, it’s hard for your team to work toward a common purpose. What’s worse, fuzzy goals don’t inspire confidence from investors and other stakeholders.

For the market research part, you’ll outline your ideal potential customer as well as the actual and potential size of your market.

Target markets identify demographic information like:

By getting specific, you’ll illustrate expertise and generate confidence. If your target audience is too broad, it can be a red flag for investors. The same applies to your market analysis when you estimate its size and monetary value.

In addition to big numbers that encompass the total market, drill down into your business’s addressable market—meaning, local numbers or numbers that apply the total to your specific segments.

You can even map your customers’ journey to better understand their needs and preferences.

Competitive research begins with identifying companies that currently occupy the market you’re looking to enter. The idea of carving out time to learn about each potential competitor you have may sound overwhelming, but it will be an extremely useful exercise.

Answer these questions about your most significant competitors:

Spend some time thinking about what sets you apart. If your idea is truly original, be ready to explain the customer pain points you see your business solving.

If your business has no direct competition, research other companies that provide a similar product or service. Next, create a table or spreadsheet listing your competitors (competitor analysis table) to include in your plan.

Describe the benefits, production process, and life-cycle of your offering and how it’s better than your competitors.

When describing benefits, focus on:

For the production process, answer how you:

Then, for your product life cycle portion, map elements like the time between purchases and up-sells, cross-sells, and down-sells.

Your marketing plan can be the difference between selling a lot and a little. Growth strategies are a critical part of your business plan.

The marketing and sales section of your business plan should touch on your target market and customer segments and highlight your:

You can also use this section of your business plan to reinforce your strengths and what differentiates you from the competition. Be sure to show your accomplishments, what you plan to do with your existing resources, and what results you expect from your efforts.

Let QuickBooks streamline your books and your business, so you can focus on what you do best.

Start hereIf you’re just starting, your business may not yet have financial data, financial statements, or comprehensive reporting. However, you’ll still need to prepare a budget and a financial plan.

If your company has been around for a while and you’re seeking investors, be sure to use the key financial statements:

Other figures you’ll want to include are profitability margins and debt levels. Make sure your figures are accurate. You can use a template to fill out your financials, such as a budget template .

Your business is only as good as the team that runs it. Identify your team members and explain why they can either turn your business idea into a reality or continue growing it.

Highlight expertise and qualifications throughout—this section of your business plan should show off your management team superstars. You should also note the roles you still need to hire to grow your company and the cost of hiring experts to assist operations.

To make informed business decisions, you may need to budget for a bookkeeper or certified public accountant (CPA). CPAs can help you review your monthly accounting transactions and prepare your annual tax return.

When outlining how much money your small business needs, try to be realistic. You can provide a range of numbers if you don’t want to pinpoint an exact number. You can also include a best-case and worst-case scenario in your financial forecasting .

Provide as much detail as possible on how much money you need and what you’ll use it for. When drafting your business plan, decide whether debt or equity funding—or a combination of both, works best for your business.

Finally, assemble a well-organized appendix for anything and everything readers will need to supplement the information in your plan. Consider any info that helps investors conduct due diligence and gives context and easy access to you or your employees.

Useful details and items to include in your appendix are:

Your appendix should be a living section of the business plan, whether the plan is a document for internal reference only or an external call for investors.

It’s a good idea to periodically revisit your business plan, especially if you want to expand. Conducting new research and updating your plan can provide answers when you hit periods of slow growth.

Here are three reasons you’ll want to consider updating your business plan:

You must deliberately manage your revenue streams, which might require shuffling things around a little to focus on what works for you.

Mid-year is a good time to refocus and revise your original plans because it allows you to adjust any goals for the second half of the year.

A business plan is a comprehensive road map for your small business’s growth and development. It communicates who you are, what you plan to do, and how you plan to do it. It also helps you attract talent and get funding for your business .

You want your business plan to be as attractive and readable as possible. Here are the best ways to make sure your business plan stands out:

Business plans are useful for raising funding but can also be great for guiding your internal processes. A free business plan template ensures you focus on concrete objectives and helps reassure outside parties that you’re planning ahead.

Accounting software can also help keep you on track, especially when it comes to presenting accurate financial information. Software like QuickBooks Online can also help you with budgeting and forecasting.

Most business plans have seven main points and key components, including an executive summary, a company description, a market analysis, details on your products and services, marketing strategies, financials, and a budget.

How long does it take to write a business plan?Writing a business plan can take a few days or weeks, depending on the level of market research you need to do. You can also take breaks to avoid errors and give yourself plenty of time to edit and review it.

Should you write a business plan in the first person?You typically want to avoid writing your business plan in the first person, as using terms like “I” and “we” can be too informal. Instead, the third person tends to work better for business plans for audiences like banks and investors.

An illustration of a person looking at a planning board to understand how to start a business." />

An illustration of a person looking at a planning board to understand how to start a business." />

Starting a business

How to start a business from scratch: 19 steps to help you succeed

An illustration of a person holding a clipboard while deciding between pricing strategies." />

An illustration of a person holding a clipboard while deciding between pricing strategies." />

14 pricing strategies and examples to try

An illustration of a business owner doing financial forecasting." />

An illustration of a business owner doing financial forecasting." />

Running a business

Financial forecasting: Definition, 7 methods + how to do it

February 20, 2024

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

**Product information

QuickBooks Live Assisted Bookkeeping: This is a monthly subscription service offering ongoing guidance on how to manage your books that you maintain full ownership and control. When you request a session with a Live Bookkeeper, they can provide guidance on topics including: bookkeeping automation, categorization, financial reports and dashboards, reconciliation, and workflow creation and management. They can also answer specific questions related to your books and your business. Some basic bookkeeping services may not be included and will be determined by your Live Bookkeeper. The Live Bookkeeper will provide help based on the information you provide.

QuickBooks Live Full-Service Bookkeeping: This is a combination service that includes QuickBooks Live Cleanup and QuickBooks Live Monthly Bookkeeping.

1. QuickBooks Online Advanced supports the upload of 1000 transaction lines for invoices at one time. 37% faster based off of internal tests comparing QuickBooks Online regular invoice workflow with QuickBooks Online Advanced multiple invoice workflow.

2. Access to Priority Circle and its benefits are available only to customers located in the 50 United States, including DC, who have an active, paid subscription to QuickBooks Desktop Enterprise or QuickBooks Online Advanced. Eligibility criteria may apply to certain products. When customers no longer have an active, paid subscription, they will not be eligible to receive benefits. Phone and messaging premium support is available 24/7. Support hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. holidays and events beyond our control. Intuit reserves the right to change these hours without notice. Terms, conditions, pricing, service, support options, and support team members are subject to change without notice.

3. For hours of support and how to contact support, click here.

4. With our Tax Penalty Protection: If you receive a tax notice and send it to us within 15-days of the tax notice we will cover the payroll tax penalty, up to $25,000. Additional conditions and restrictions apply. See more information about the guarantee here: https://payroll.intuit.com/disclosure/.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

QuickBooks Money: QuickBooks Money is a standalone Intuit offering that includes QuickBooks Payments and QuickBooks Checking. Intuit accounts are subject to eligibility criteria, credit, and application approval. Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. QuickBooks Money Deposit Account Agreement applies. Banking services and debit card opening are subject to identity verification and approval by Green Dot Bank. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

QuickBooks Commerce Integration: QuickBooks Online and QuickBooks Commerce sold separately. Integration available.

QuickBooks Live Bookkeeping Guided Setup: The QuickBooks Live Bookkeeping Guided Setup is a one-time virtual session with a QuickBooks expert. It’s available to new QuickBooks Online monthly subscribers who are within the first 30 days of their subscription. The QuickBooks Live Bookkeeping Guided Setup service includes: providing the customer with instructions on how to set up chart of accounts; customized invoices and setup reminders; connecting bank accounts and credit cards. The QuickBooks Live Bookkeeping Guided Setup is not available for QuickBooks trial and QuickBooks Self Employed offerings, and does not include desktop migration, Payroll setup or services. Your expert will only guide the process of setting up a QuickBooks Online account. Terms, conditions, pricing, special features, and service and support options subject to change without notice.